The Best Guide To Paul B Insurance

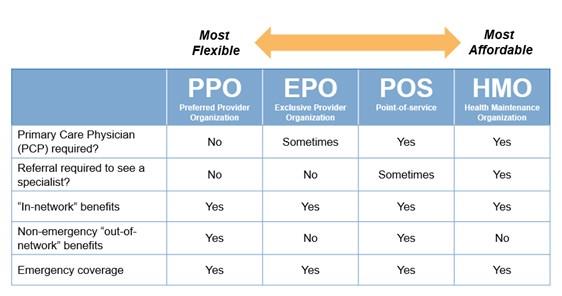

An HMO might need you to live or function in its service location to be eligible for coverage. HMOs typically provide incorporated treatment and concentrate on prevention and also health. A kind of strategy where you pay much less if you use medical professionals, hospitals, and also other healthcare carriers that come from the strategy's network.

A kind of health insurance plan where you pay less if you make use of suppliers in the plan's network. You can utilize physicians, medical facilities, and suppliers outside of the network without a reference for an additional expense.

You have options when you purchase health and wellness insurance. If you're purchasing from your state's Market or from an insurance policy broker, you'll select from health insurance arranged by the level of advantages they offer: bronze, silver, gold, and also platinum. Bronze plans have the least coverage, and also platinum plans have one of the most.

Little Known Facts About Paul B Insurance.

If you see a medical professional who is not in the network, you'll may have to pay the complete costs yourself. This is the price you pay each month for insurance coverage.

A copay is a level fee, such as $15, that you pay when you get care. These fees vary according to your plan and also they are counted towards your deductible.

Higher out-of-pocket expenses if you see out-of-network medical professionals vs. in-network providers, More paperwork than with other strategies if you see out-of-network companies Any kind of in the PPO's network; you can see out-of-network physicians, but you'll pay more. This is the expense you pay monthly for insurance policy. Some PPOs might have a deductible.

Paul B Insurance - An Overview

A copay is a level cost, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the fees for care, for instance 20%. If your out-of-network physician charges greater than others in the area do, you might have to pay the equilibrium after your insurance coverage pays its share.

Reduced premium than a PPO offered by the very same insurance firm, Any kind of in the EPO's network; there is no coverage for out-of-network suppliers. This is the cost you pay each month for insurance coverage. Some EPOs may have an insurance deductible. A copay is a level fee, such as $15, that you pay when you obtain treatment.

This is the expense you pay each month for insurance. Your plan might need you to pay the amount of a deductible prior to it covers treatment past preventative services.

See This Report about Paul B Insurance

We can't prevent the unanticipated from occurring, however often we can shield ourselves as well as our family members from the worst of the monetary after effects. 4 kinds of insurance policy that many financial specialists advise consist of life, health and wellness, auto, and lasting disability.

It includes a survivor benefit and also a cash worth element. As the worth expands, you can access the address cash by taking a car loan or withdrawing funds as well as description you can finish the plan by taking the cash money worth of the plan. Term life covers you for a set quantity of time like 10, 20, or 30 years and also your premiums remain steady.

2% of the American population lacked insurance policy coverage in 2021, the Centers for Illness Control (CDC) reported in its National Center for Health And Wellness Stats. More than 60% got their coverage through an employer or in the personal insurance policy market while the remainder were covered by government-subsidized programs consisting of Medicare as well as Medicaid, professionals' benefits programs, as well as the government market developed under the Affordable Treatment Act.

Fascination About Paul B Insurance

Investopedia/ Jake Shi Lasting special needs insurance policy sustains those who end up being not able to work. According to the Social Safety Administration, one in four workers entering the labor force will end up being handicapped prior to they get to the age of retired life. While medical insurance spends for a hospital stay and also medical bills, you are often strained with every one of the expenses that your income had actually covered.

Several plans pay 40% to 70% of your revenue. The expense of special needs insurance policy is based on numerous factors, including age, way of life, and also health.

Nearly check out here all states call for chauffeurs to have car insurance policy and also minority that do not still hold drivers monetarily in charge of any damage or injuries they trigger. Right here are your choices when buying car insurance coverage: Responsibility coverage: Pays for building damages and also injuries you cause to others if you're at fault for a mishap and also covers lawsuits prices as well as judgments or settlements if you're sued since of an automobile crash.

The 3-Minute Rule for Paul B Insurance

Company protection is typically the very best option, but if that is not available, get quotes from a number of service providers as several supply price cuts if you purchase greater than one kind of coverage.

When contrasting plans, there are a couple of variables you'll wish to consider: network, expense as well as benefits. Look at each plan's network and identify if your favored service providers are in-network. If your physician is not in-network with a strategy you are thinking about however you wish to continue to see them, you might desire to think about a various plan.

Attempt to discover the one that has one of the most benefits and any certain doctors you need. Many employers have open enrollment in the fall of each year. Open registration is when you can transform your advantage options. You can change wellness strategies if your employer offers even more than one strategy.

About Paul B Insurance

You will have to pay the costs on your own. Nevertheless; it may cost much less than individual medical insurance, which is insurance policy that you get on your own, and also the advantages may be better. If you get Federal COBRA or Cal-COBRA, you can not be refuted insurance coverage due to a medical problem.

Obtain a letter from your health and wellness strategy that states the length of time you were insured. This is called a Certification of Praiseworthy Coverage. You might require this letter when you get a brand-new team health plan or get an individual wellness plan. Private health insurance are plans you get by yourself, for on your own or for your family members.

Some HMOs supply a POS plan. Fee-for-Service plans are typically assumed of as standard plans.